In recent years, green financing has become the success story in the professional and private real estate sector. We covered the subject with Sandra Vandersmissen, a specialist in listed real estate at BNP Paribas Fortis.

Vandersmissen Sandra – BNP Paribas Fortis

Why do investors choose green financing?

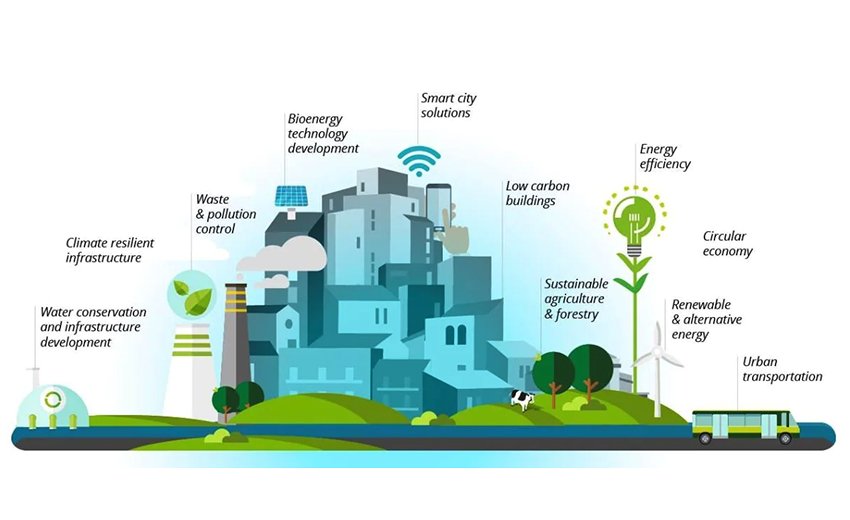

They know that they will invest in the future and give more meaning to their investment by choosing to finance projects that contribute to sustainable development. If an (institutional or private) investor analyses the credit composition of issuing companies, the proportion of green financing will say a lot about their profile, their strength and their confidence in the future. In addition, since each company must now publish its carbon roadmap for 2050, it has every interest in getting started now, just to green its investment portfolio.

For their part, issuers have a better chance of finding their financing, as demand is strong for green bonds. Management houses (private banking and managers of intentional funds) receive many such requests from their end clients.

At BNP Paribas Fortis, how do you proceed before launching a green product?

Within BNPPAM, our asset management subsidiary, we have a team of analysts who assign an ESG rating to each issuing company. In private banking, we use scores in agreement with our customers. With us, it is calculated in shamrocks. And it takes a minimum of 5 out of 8 shamrocks for the issuing company to be considered sustainable and for its bonds, green and others, to be purchased in our portfolios. We don’t score each issue but the issuing companies. For us, the overall ESG rating of an issuer is more important than the nature of each bond, its cost not being lower than others.

And does it work?

It is a market that is still growing. It is generally considered that the green part in the bond market is around 10%, so there is still room for growth. On the other hand, it works since each green bond issued generally ends at two or three times the base. This type of financing is particularly important for the real estate sector due to its capital intensity. To finance their projects, real estate professionals issue many green bonds or loans (in this sector, all new investments must also be sustainable). And it’s a virtuous circle: without the help of the real estate sector, Europe will never reach the carbon targets of 2050. And so, everyone is moving in the right direction!

© Deloitte

Tags: BNP Paribas Fortis, green bonds, green financing, listed real estate, Sandra Vandersmissen.